“They just basically said forget about it,” said Julianne Sylva, a child abduction investigator who is now deputy district attorney in Santa Clara County, Calif.

The government, which by its own admission has data that could be helpful in tracking down the thousands of missing children in the United States, says that taxpayer privacy laws severely restrict the release of information from tax returns. “We will do whatever we can within the confines of the law to make it easier for law enforcement to find abducted children,” said Michelle Eldridge, an I.R.S. spokeswoman.

The privacy laws, enacted a generation ago to prevent Watergate-era abuses of confidential taxpayer information, have specific exceptions allowing the I.R.S. to turn over information in child support cases and to help federal agencies determine whether an applicant qualifies for income-based federal benefits.

But because of guidelines in the handling of criminal cases, there are several obstacles for parents and investigators pursuing a child abductor — even when the taxpayer in question is a fugitive and the subject of a felony warrant.

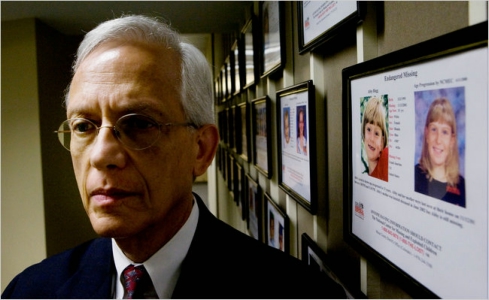

Ernie Allen, chief of the center, says, “It's one of those areas where

you would hope that common sense would prevail.” |

|

“It's one of those areas where you would hope that common sense would prevail,” said Ernie Allen, president and chief executive of the National Center for Missing and Exploited Children. “We are talking about people who are fugitives, who have criminal warrants against them. And children who are at risk.”

About 200,000 family abductions are reported each year in the United States, most of which stem from custody disputes between estranged spouses. About 12,000 last longer than six months, according to Justice Department statistics, and involve parental abductors who assume false identities and travel the country to escape detection.

But, counterintuitive as it may seem, a significant number file one of bureaucracy's most invasive documents, a federal tax return. A study released by the Treasury Department in 2007 examined the Social Security numbers of 1,700 missing children and the relatives suspected of abducting them, and found that more than a third had been used in tax returns filed after the abductions took place.

Criminologists say it is unclear what motivates a child abductor to file a tax return: confusion, financial desperation for a refund or an attempt to avoid compounding their criminal problems by failing to pay taxes. |

Whatever the reason, the details in a return on an abductor's whereabouts, work history and mailing address can be crucial to detectives searching for a missing child.

“It doesn't make a whole lot of sense,” said Harold Copus, a retired F.B.I. agent who investigated missing child cases, of why abductors provide such information. “But if they were thinking clearly, they wouldn't have abducted their child in the first place.”

The law forbids the I.R.S. from turning over data from tax returns unless a parental abduction is being investigated as a federal crime and a United States district judge orders the information released. But the vast majority of parental abduction cases are investigated by state and local prosecutors, not as federal crimes, say investigators and missing children's advocates. Even when the F.B.I. does intercede in parental abduction cases, requests for I.R.S. data are rarely granted.

When the Treasury Department study identified hundreds of suspected abductors who had filed tax returns, for instance, a federal judge in Virginia refused to issue an order authorizing the I.R.S. to turn over their addresses to investigators. The judge, Leonie M. Brinkema, declined to discuss her decision.

Advocates for missing children say that federal judges often argue that parental abductions are better suited to family court than criminal court.

"Ageing" an image of a girl taken by a relative at 4. She would now be 17. |

|

“There's this sense that because the child is with at least one of their parents, it's not really a problem,” said Abby Potash, director of Team Hope, which counsels parents who are searching for a missing child. Ms. Potash's son was abducted by a relative and kept for eight months before he was recovered. “But when you're the parent who's left behind, it is devastating. You're being robbed of your son or daughter's childhood.”

In Ms. Lau's case, her search for her missing son dragged on for two years after the I.R.S. refused investigators' request for her ex-husband's tax return. She actually got the tip from the I.R.S., which disallowed her request to claim the boy on her own tax return because someone else had. The boy was eventually found in Utah, after his photo appeared in a flier distributed by missing children's groups, and he was reunited with his mother at age 15 — five years after they were separated.

I.R.S. officials are quick to point out that they have worked closely with missing children's advocates in some areas. The I.R.S.'s “Picture Them Home” program has included photos of thousands of missing children with forms mailed to millions of taxpayers since 2001. More than 80 children were recovered with the help of that program. |

Still, attempts to change the law to give the tax agency more latitude have sputtered over the last decade. Dennis DeConcini, a former Democratic senator from Arizona, lobbied for the change in 2004 on behalf of a child advocacy group, but said that it never gained traction because some members of Congress feared that any release of I.R.S. data could lead to a gradual erosion of taxpayer privacy. In recent years, much of the legislation involving missing children has focused on international abductions.

One problem missing children's advocates have wrestled with in proposing legislation is determining how much information the I.R.S. should be asked to release from a suspected abductor's tax return. Should disclosure be required only if a child's Social Security number is listed on a return? Should child abduction investigators be given only the address where a tax return was mailed? Or the location of an employer who has withheld taxes on a suspected abductor?

Griselda Gonzalez, who has not seen her children since 2007, holds fleeting hope that some type of information might reunite her family. Diego and Tammy Flores were just 2 and 3 years old when their father took them from their home in Victorville, Calif., for a weeklong visit and never returned. After Ms. Gonzalez reported their disappearance, a felony warrant for kidnapping was issued for the father, Francisco Flores. His financial records suggest he meticulously planned his actions for months — withdrawing money from various accounts and taking out a second mortgage — so Ms. Gonzalez doubts he would claim the children as dependents on a tax return.

But it gnaws at her that some federal laws seemed more concerned with the privacy of a fugitive than the safety of children.

“When your kids are taken from you, the hardest part is at night, thinking about them going to sleep,” she said. “You wonder who's tucking them in, who will hug them if they have a bad dream or taking them to the bathroom if they wake up. And you ask yourself whether you've done everything possible to find them.”

“It would be good to know that you tried everything,” she said.

Missing children's advocates see the I.R.S. data as a potentially powerful resource.

“There are hundreds of cases this could help solve,” said Cindy Rudometkin of the Polly Klaas Foundation. “And even if it helped solve one case — imagine if that child returned home was yours.”

|